Whether you're selling payment solutions, expense management tools, or financial software, your current customers and future prospects are looking for evidence of success from companies similar to theirs. But how do we separate the wheat from the chaff?

This is where a well-structured customer advocacy program becomes invaluable.

There's simply no better way to tell your story than through your customers' voices. When a prospect hears how your solution helped another company increase their acceptance rates, reduce fraud, or save 20 hours per month on reconciliation, it carries far more weight than any sales pitch.

However, building an effective customer advocacy program in FinTech comes with unique challenges. You need to navigate compliance concerns, translate complex metrics into compelling stories, and maintain an always-on approach that aligns with your industry.

In this article, I'll share practical strategies for building a program that drives real business results.

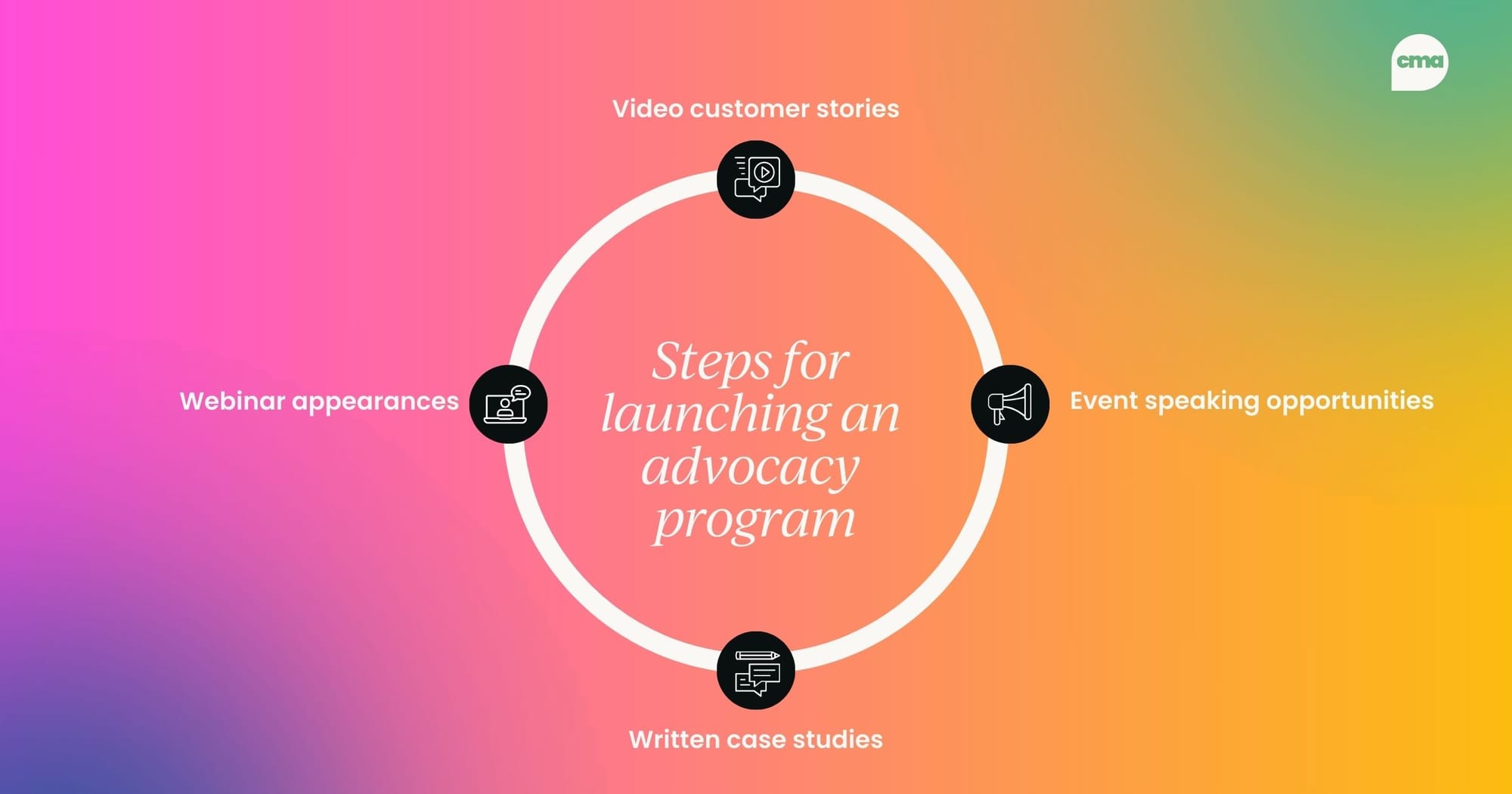

Key steps for launching a customer advocacy program

The foundation of any successful customer advocacy program lies in its initial setup. From my experience, the most critical first step is getting the right stakeholders involved from day one. This means bringing together leaders from marketing, sales, customer success, and account management right from those initial discussions.

Your program needs clear goals that align with your business objectives. Start by identifying your ideal customers from your existing customer base – those big brand names you'd want as advocates. You’ll need to consider their size, verticals, and use cases. Then once you’ve established that, it’s time to determine what types of assets you want to create. That could be:

- Webinar appearances

- Video customer stories

- Written case studies

- Event speaking opportunities

Most importantly, establish how you'll recruit these customers both at launch and into the future. This requires buy-in from all customer-facing teams, helping them understand how customer advocacy can enable their success.

Common mistakes in advocacy program setup

1. No buy-in

One of the biggest mistakes I've learned from – and one I unfortunately see frequently – is not securing comprehensive business buy-in from the very beginning. Instead of having two or three separate conversations and then bringing everyone on board, we need to involve all key stakeholders from the very start.

2. Periodic vs. continuous advocacy

Another common pitfall is treating advocacy as a periodic initiative rather than a continuous strategy. A truly great customer advocacy program enables your sales team to discuss advocacy during their initial conversations with prospects, planting the seeds for future success stories even before they become customers.

This “always-on” approach helps build a consistent pipeline of customer stories, rather than finding yourself constantly scrambling to find advocates when you need them.

When sales teams understand this approach, they can naturally integrate advocacy discussions into their deal-closing processes, setting the stage for future collaboration.

The unique challenges and opportunities of advocacy in fintech

It’ll come as no surprise to hear that the fintech sector presents distinct challenges and opportunities for customer advocacy programs.

One of the primary challenges we face lies in effectively communicating key metrics that matter in our industry.

For example, with payment services, we're looking at metrics like acceptance rates and fraud rates, but in other areas like expense management, your focus tends to shift to time savings and efficiency gains.

So, when crafting fintech customer stories, it's crucial to dig deep into these specific metrics.

Take this as an example. When working with expense management platforms, we focus on quantifying the time saved during month-end reconciliation and calculating the ROI of automating processes that previously relied on petty cash.

The key is structuring these stories around three key elements:

- Where the customer was before implementing the solution

- The implementation journey

- The measurable results and improvements achieved

Selling advocacy programs internally

Real customer advocacy brings the concept of customer centricity to life by showing how real customers use your product to solve real problems.

When selling your advocacy program internally, your best bet is to focus on how it enables different teams to achieve their goals. By appealing to their desires and goals, you’ll be able to get them on board much easier.

For sales teams, customer advocacy provides powerful assets that align with specific use cases, verticals, or company sizes. It also facilitates customer reference calls that can help close deals.

Marketing teams benefit from multiple assets for cross-selling and upselling, while customer success teams can use advocacy content as engagement pieces to showcase how similar customers are maximizing value.

Creating engaging customer advocacy content

In fintech, use cases and customer stories are particularly powerful tools for elevating your brand.

In my experience, I've found that video content often proves more compelling than written case studies, although both have their place. When showcasing your content, the key is presenting information in digestible, interesting ways – perhaps through engaging infographics or creative visual presentations that make metrics stand out.

Navigating compliance and privacy in advocacy

When dealing with sensitive financial information, compliance and privacy concerns are paramount. I've found that the best approach is to express improvements in percentages rather than absolute numbers.

Always remember that you should only be as comfortable as your customer wants to be. Establish a clear approval process that involves multiple stakeholders, both internal and external. Share drafts, gather feedback, and be prepared for multiple iterations before reaching final approval.

Adapting customer advocacy programs to rapidly changing industries

The fintech industry moves fast, with new developments at every turn. To keep up with the times, your advocacy program must always remain flexible and adaptable. What you can do, is ensure it continues to align with your company's North Star metrics and business goals by maintaining regular communication with brand teams, CMOs, and other business leaders.

The key to future-proofing your program is maintaining those crucial stakeholder relationships and ensuring your advocacy efforts continue to support and promote the business in the most effective way possible.

Fintech advocacy in a nutshell

As a B2B marketer specializing in customer and product marketing, I've spent the last decade deeply immersed in customer advocacy, particularly within the FinTech sector.

My journey began in call center management, where I developed a fundamental understanding of customer needs while helping people with their broadband queries. This experience taught me the most crucial aspect of customer advocacy: the art of listening. Without listening, you’re fighting an uphill battle.

And listening is just the beginning. A successful customer advocacy program isn’t just about collecting testimonials – it’s about fostering meaningful relationships that drive mutual value.

When you prioritize customer engagement and remain adaptable to change, you can build an advocacy program that not only amplifies your brand but also delivers real, lasting impact for your FinTech organization.

This article is based on Dean's appearance on the Customer Marketing Catch-Up podcast. You can listen to the full episode, and others like it, in our podcast hub.